Why Repatriating Factories Could Halve the S&P 500 and Devastate Investors

I remain skeptical about manufacturing returning to American shores. But if it were to happen, the S&P 500 would likely plunge by at least 50%, devastating passive investors and rendering traditional value investing obsolete.

Next, I will explain why when the manufacturing industry returns, the US stock market will fall by another half.

I. The ROE Miracle Behind U.S. Stocks

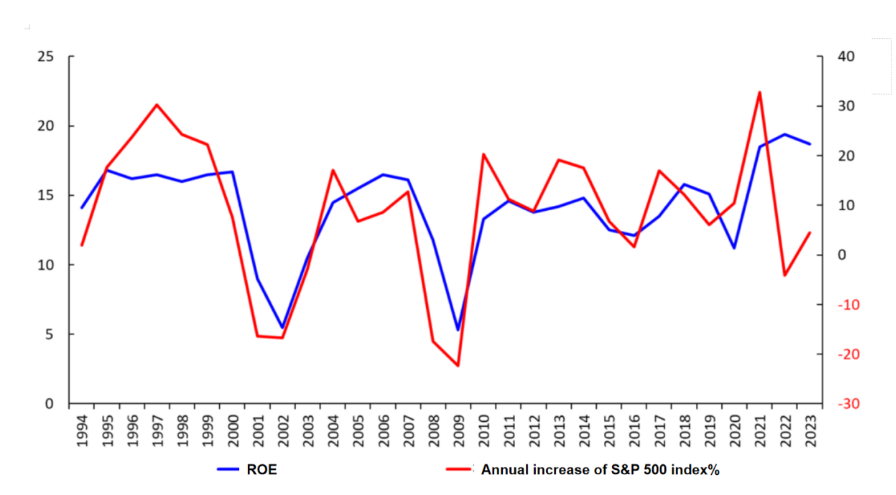

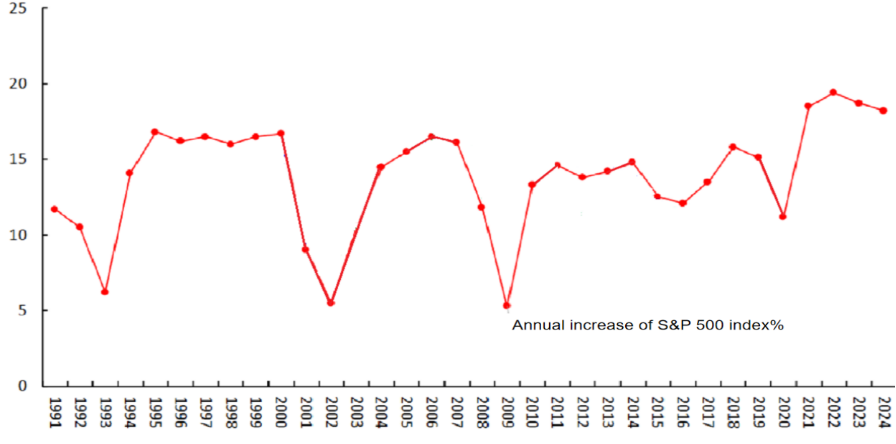

As shown in Figure 1 , the S&P 500’s return on equity (ROE) has exhibited remarkable resilience over the past 34 years. Even during crises, ROE rarely dipped below 5%, consistently hovering between 15-17%. This stability fueled the market’s relentless climb.

II. ROE Drives Market Returns

III. Why is it that only the US stock market has experienced long-term bull markets multiple times in the world?

Since 1949, U.S. markets have been in bull territory 80% of the time—a statistical anomaly globally. The secret? Sector composition.

Compare China, the world’s manufacturing hub, where indices have flatlined for decades. The critical difference lies in market structure ( Table 1 ):

– China : Dominated by cyclical (steel, property) and financial stocks—low-growth, volatile sectors.

– U.S. : Tech-heavy (50%+ of S&P 500), enabling stable earnings growth and premium valuations (25x+ P/E).

Table 1: Sector Weightings in Major Indices

IV. The Manufacturing Paradox: A Market Killer

Now, Washington’s push—via tariffs, ship docking fees, and fossil fuel subsidies—aims to repatriate factories. But this risks triggering a valuation collapse:

1.The Valuation Time Bomb

Traditional manufacturing sectors—coal, steel, autos, shipbuilding, cement, chemicals—share three deadly traits for investors:

Brutal cyclicality (earnings swing wildly with commodity prices)

Low-multiple reality (10x P/E at best vs. S&P 500’s current 25x)

Growth constraints (unlike scalable tech businesses)

Case in point: U.S. Steel’s stock (see Chart 4) has languished below $45 for years. Flood the market with similar industrial IPOs, and the S&P’s premium valuation could easily halve—mirroring China’s perennially depressed stock markets.

2.The Automation Paradox

Proponents argue America will focus on high-tech manufacturing (robotics, semiconductors). But here’s the rub:

✓ 80% of Americans support reshoring

✗ 80% refuse factory jobs

✓ Washington keeps touting coal/steel revival

The Bottom Line : Flooding markets with low-multiple industrials could halve the S&P’s P/E ratio, ending America’s bull market exceptionalism. China’s stagnant bourses offer a grim preview.

Investor Takeaways

• Sector rotation risk: Industrials’ rising weight could trigger massive index fund rebalancing

• Profit margin compression: Legacy manufacturers lack pricing power of FAANG peers

• Policy whiplash: Subsidy-driven growth rarely sustains premium valuations

America’s manufacturing nostalgia might win votes—but it could cost investors trillions.